Bryan, Garnier & Co, a leading pan-European investment bank focusing on growth companies, is delighted to announce that Alexandre has been appointed Senior Associate in the Business & Tech-enabled Services Team.

Bryan, Garnier & Co, a leading pan-European investment bank focusing on growth companies, is delighted to announce that Alexandre has been appointed Senior Associate in the Business & Tech-enabled Services Team.

Alexandre joined Bryan, Garnier & Co in November 2021 as Senior Associate in the Business & Tech-enabled Services team.

He gained experience in corporate finance during his internships spent at MBA Capital and Rothschild & Co (Transaction R) and then passed 6 years at PwC in the Audit and Transaction departments. During his career, he has developed a knowledge of various sectors including textile, aerospace, agrifood, automotive and waste treatment.

Alexandre holds a double degree master in Management and Msc in Finance from EDHEC Business School and also holds a chartered accountant diploma (French CPA).

Fast Growth Icons

28 October 2021 | Berlin

Fast Growth Icons

Once again, Bryan, Garnier & Co is supporting this year’s Fast Growth Icons in Berlin.

Fast Growth Icons is focused on practical advice for tech growth businesses, coupled with networking, bringing together around 100 founders and CEOs of highly successful and fast-growing companies.

Event highlights

- Invitation-only network for founders and CEOs of the most successful tech businesses

- Focuses on the key areas that growth businesses need to get right to maintain and manage rapid growth and build the €100m+ revenue businesses of the future

- Closed-doors environment where founders can openly share their ambitions and challenges and get valuable insights from speakers and participants

- Attended by some of the region’s most interesting founders (the typical attendee is the founder of a business with €10m-€100m turnover and/or 75-500 staff, growing at over 50% p.a.).

Registration

Registration is closed

Halla Koppel joins Bryan, Garnier & Co as Vice President in Investment Banking

Bryan, Garnier & Co, a leading pan-European investment bank focusing on growth companies, is delighted to announce that Halla has been appointed as Vice President in Investment Banking.

Halla joined Bryan, Garnier & Co in September as Vice President in investment banking with a specialisation in ESG products. Previously Halla worked at Goldman Sachs, as part of their cross-asset coverage for Nordic institutional clients. Halla has an MBA from the University of Oxford, holds a Certificate in Sustainable Finance from Cambridge University and a CFA level 4 in ESG investing. Halla also has a long career in media and entertainment behind her, has climbed four of the World´s highest Seven Summits and is a keen motorcyclist.

Caroline Brun joins Bryan, Garnier & Co as Vice President in the Business & Tech-enabled Services Team

Bryan, Garnier & Co, a leading pan-European investment bank focusing on growth companies, is delighted to announce that Caroline has been appointed as Vice President in the Business & Tech-enabled Services Team.

Caroline joined Bryan, Garnier & Co in September 2021 as Vice President in the Business & Tech-enabled Services team. She has 10 years’ corporate finance experience gained at Neuflize OBC Corporate Finance team and Deloitte Transaction Services. During her career, Caroline has been responsible for numerous deals with companies and investment funds, including La Grosse Equipe/Satisfaction, MagicOnline/Banque Palatine & NeuflizeOBC, Solware/Andera Acto and Be Relax/Activa Capital. She is a graduate of NEOMA Business School (Sup de Co Reims).

Bryan, Garnier & Co Monthly IPO Fireside Chat

Thursday 15 July 2021 | 10h00 CET - 10h45 CET

Bryan, Garnier & Co Monthly IPO Fireside Chat

WITH:

Greg Revenu | Co-founder & Managing Partner

Pierre Kiecolt-Wahl | Partner and Head of Equity Capital Markets

THIS MONTH:

TBC

The Bryan, Garnier & Co monthly IPO fireside chat is part of a series of conversations set up to discuss the capital markets environment, recent key transactions and trends (direct listings, SPACs…), institutions investors behaviours (cornerstone, crossovers…), valuation dynamics (Europe vs US). These conversations are a unique opportunity for private equity professionals to get a comprehensive and updated view on the market dynamics in an interactive format.

Registration

Registration is closed

Jérôme Guyot joins Bryan, Garnier & Co as Managing Director – Equity Capital Markets

PARIS, 1 July 2021 – Bryan, Garnier & Co, a leading pan-European investment bank focusing on growth companies, is delighted to announce that Jérôme Guyot has been appointed as Managing Director, ECM at the firm.

Based in Paris, Jérôme will help further drive Bryan, Garnier & Co’s ECM franchise and help the firm achieve its ambition to become the leader in ECM for growth companies.

Jérôme, 45, has a 15-year career in the investment banking industry. Before joining Bryan, Garnier & Co, he worked at a variety of companies including Gilbert Dupont – Groupe Société Générale, where he was Head of ECM and then Co-Head of Corporate Finance, and Groupe Crédit du Nord as Director, ECM.

Over his career, Jérôme has executed more than 70 ECM transactions across a range of industries, including tech, healthcare, and consumer, which are core sectors for Bryan, Garnier & Co. He has completed advisory and capital markets transactions for clients such as Advicenne, Alchimie, Ateme, Ekinops, Fermentalg, Gensight Biologics, Inventiva, Median Technologies, Nacon, Nanobiotix and Sidetrade.

Christophe Alleman, Co-Head Equity Capital Markets states: “We are delighted to welcome Jérôme to Bryan, Garnier & Co as Managing Director in our Equity Capital Markets franchise. Jérôme brings a long and established track record of ECM success in the French small and mid-cap market, which represents the largest pool of publicly listed small and mid-cap companies in continental Europe.”

Jérôme Guyot comments: “I am more than happy to join Bryan, Garnier & Co’s highly committed team to help expand our ECM franchise. I have been very impressed by the ability of the firm to bring in strategic cornerstone investors in the context of IPOs and follow-on offerings. This is a perfect illustration of the firm’s value proposition to support growth companies and disruptive players at all stages of their development”.

With more than 60 private and public capital-raising and M&A transactions closed in 2020, Bryan, Garnier & Co benefits from longstanding leadership in the healthcare, technology, business services and environmental sectors in Europe. Over the past 36 months, Bryan, Garnier & Co has led more than 40 ECM transactions across nine countries, raising over EUR 2.5bn. Recent successes include the IPOs and/or follow-ons for HDF Energy (Euronext Paris), Mister SPEX (Deutsche Boerse), Carbios (Euronext Paris), Azelio (NASDAQ Stockholm), McPhy Energy (Euronext Paris), Linas Matkase (NASDAQ Stockholm), Heidelberg Pharma (Deutsche Börse), Swedish Stirling (NASDAQ Stockholm), Basilea (SIX) GenSight (Euronext Paris), and Valneva (NASDAQ / Euronext Paris).

Additional recent transactions include the acquisition of DL Software by TA Associates, the sale of smartTrade to leading software private equity investor Hg Capital, the take-private of ITSM player Easyvista by Eurazeo, capital for circular economy player asgoodasnew, the sale of Specim to Konica Minolta and the sale of BlueBee to Illumina. Over the years, Bryan, Garnier & Co has distinguished itself by backing some of the most disruptive companies in the domain of alternative proteins (Prolupin), green hydrogen (McPhy Energy), cannabis (Canopy Growth), 3D printing (Materialise), blockchain and cryptocurrencies (Bitfury Group), and mRNA biotech (Moderna and BioNTech).

Sanjin Goglia, former cybersecurity lead at Atos Group M&A joins Bryan, Garnier & Co as Managing Director

PARIS, 1 June 2021 – Bryan, Garnier & Co, a leading pan-European investment bank focusing on growth companies, is delighted to announce that Sanjin Goglia has been appointed as Managing Director at the firm.

Based in Paris, Sanjin will take up this new position to help develop Bryan, Garnier & Co’s business and strategy in the rapidly growing cybersecurity and compute infrastructure markets in Europe.

Sanjin, 40, has a distinguished career in digital security gained from working at large corporates such as Siemens and Deloitte as well as small start-ups focused on data analytics. He joined Atos in 2011, where he held multiple roles including; dealmaker for large, cross-border deals, global business leadership roles in the big data and cybersecurity divisions, and finally in Group M&A. In this position, he was responsible for advancing the cybersecurity acquisition strategy across Europe and US as one of the key focus areas of the Group.

During Sanjin’s career he has worked with clients on security deals and programmes around the world as well as on multiple recent cybersecurity acquisitions by Atos.

Olivier Beaudouin, Partner within the Technology team states: “We are delighted to welcome Sanjin to Bryan, Garnier & Co. He brings both a wealth of business experience and an extensive network in some of the key technology growth markets in Europe, which will help us expand our business footprint and support our strategic ambitions”.

Sanjin Goglia comments: “I have been impressed by Bryan, Garnier & Co’s highly committed team and their deep focus on building distinguished industry expertise. With strong recognition in the technology markets and a successful track record in supporting growth companies and their shareholders at all stages of their development, the firm is ideally positioned to become a leading cybersecurity and compute infrastructure advisor in Europe”.

With more than 60 private and public capital-raising and M&A transactions closed in 2020, Bryan, Garnier & Co benefits from its longstanding leadership in the healthcare, technology and environmental sectors in Europe. Recent transactions in the tech space include the acquisition of DL Software by TA Associates, the sale of Easyvista to Eurazeo, the sale of Specim to Konica Minolta, the acquisition of Diapason by Apax, the sale of Ginolis to Cellink, the investment of Hg Capital into Smarttrade.

Over the years, Bryan, Garnier & Co has been active in the cybersecurity and infrastructure fields with deals including a EUR 20m series C financing for cyber threat intelligence company EclecticIQ, the acquisition of IT infrastructure and cybersecurity company Metsys by European Digital Group, the acquisition of Kompetera by Advania, a USD 80m series D financing for blockchain unicorn Bitfury and the sale of the cybersecurity specialist Lexsi to Orange Cyber Defense.

Serving the future

Until the pandemic, catering was a EUR 230 billion industry dominated by four traditional players. It was already facing multiple headwinds such as tougher regulations, quality and health requirements and most notably financial dynamics that mar their margins.

The main business driver of catering is the ever growing expectations of consumers. In the last decade, incumbent companies initiated diverse operations mainly drove by digitalization to boost their performance and address consumers’ needs. Despite their efforts, their transformation is still slowed down by their substantial size and what we call “the burden of tradition”.

Then along came Covid-19, bringing the industry to a near standstill. It has slashed demand and hammered caterers’ revenues. The shift to home working, one main feature of the pandemic, has handed an advantage to other food services actors, such as food retailers and delivery companies, who are now challenging traditional caterers. The fact that this shift may become mainstream in a post Covid-19 world could destroy 20% of the traditional catering business. It is to say the pandemic has bolstered the need for incumbent companies to rewrite their business model in order to keep up faster with consumers desire of increased convenience and healthiness.

In a more competitive environment, adapting to the “new normal” will involve an intensified focus on employee dining experience. We see multi-channel offers, with an intensified focus on delivery and digital solutions, as a model proving successful. The opportunity is for catering companies to progress internally and more efficiently through partnerships, acquisitions, working with small agile FoodTech start-ups and devising more flexible business models. There’s huge untapped potential for all food actors to reach new markets.

Can the catering industry adapt to the post-covid world?

To find out more, watch the teaser video about our new white paper “Serving the future”.

DISCLAIMER

Bryan Garnier & Co, registered in France no. 452 605 512 is a MiFID branch of Bryan Garnier & Co Limited (a UK company registered under the number 03034095) and is authorized and regulated by the Financial Conduct Authority and the Autorité des Marchés Financiers (AMF). Registered address: 26 avenue des Champs Elysées, Paris 75008.

This has been prepared solely for informational purposes, and is intended only for use by the designated recipient(s). This information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed. All information is subject to change without notice. This does not constitute a solicitation or offer to buy or sell securities or any other instruments, or a recommendation with respect to any security or instrument mentioned herein. This is not a confirmation of terms of any transaction. No representations are made herein with respect to availability, pricing, or performance. Additional information available on request.

This recording should only be listened to by those persons to whom it is addressed and is not intended to be relied upon by any person without subsequent written confirmation of its contents. If you have received this information in error, please destroy it and delete it from your computer. Any form of reproduction, dissemination, copying, disclosure, modification, distribution and/or publication of this recording is strictly prohibited. Please note that any views or opinions presented in this podcast are solely those of the participants and do not necessarily represent those of Bryan, Garnier & Co. Finally, the recipient should check this source and any attachments for the presence of viruses. Bryan, Garnier & Co accepts no liability for any damage caused by any virus transmitted by this communication.

Download report

Please complete the form below to receive a download link.

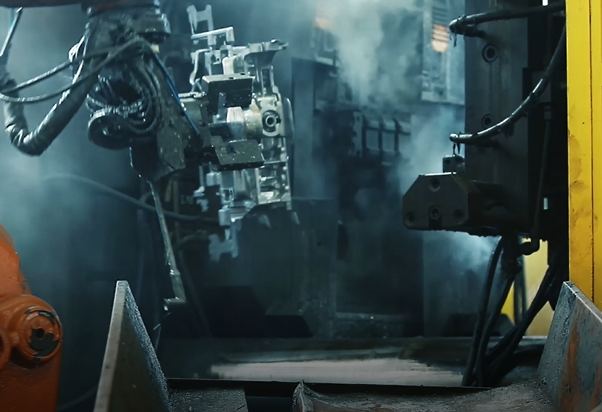

The giant robotics leap

The pandemic is accelerating the digitalization of industry and the move to smarter factories and warehouses. Surging e-commerce is driving a need for optimized manufacturing processes and reduced supply-chain lead times.

DISCLAIMER

Bryan Garnier & Co, registered in France no. 452 605 512 is a MiFID branch of Bryan Garnier & Co Limited (a UK company registered under the number 03034095) and is authorized and regulated by the Financial Conduct Authority and the Autorité des Marchés Financiers (AMF). Registered address: 26 avenue des Champs Elysées, Paris 75008.

This has been prepared solely for informational purposes, and is intended only for use by the designated recipient(s). This information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed. All information is subject to change without notice. This does not constitute a solicitation or offer to buy or sell securities or any other instruments, or a recommendation with respect to any security or instrument mentioned herein. This is not a confirmation of terms of any transaction. No representations are made herein with respect to availability, pricing, or performance. Additional information available on request.

This recording should only be listened to by those persons to whom it is addressed and is not intended to be relied upon by any person without subsequent written confirmation of its contents. If you have received this information in error, please destroy it and delete it from your computer. Any form of reproduction, dissemination, copying, disclosure, modification, distribution and/or publication of this recording is strictly prohibited. Please note that any views or opinions presented in this podcast are solely those of the participants and do not necessarily represent those of Bryan, Garnier & Co. Finally, the recipient should check this source and any attachments for the presence of viruses. Bryan, Garnier & Co accepts no liability for any damage caused by any virus transmitted by this communication.

Industrial IoT

The pandemic is accelerating the digitalization of industry and the move to smarter factories and warehouses. Surging e-commerce is driving a need for optimized manufacturing processes and reduced supply-chain lead times.

The behavioural changes caused by the COVID-19 crisis are here to stay and digitalization is speeding up in every aspect of our lives. More importantly, we are taking giant leap towards “industry 4.0”, defined by hyper connectivity, hyper mobility, and hyper intelligence.

In this paper, we look at how the pandemic is accelerating the already bright landscape of robotics and automation in production and logistics. We explore the main technological trends such as autonomous mobile robots, collaborative robots, 5G and “untact” technologies. We highlight how the requirements and challenges of a full IoT environment go beyond hardware, demanding more interoperability and integration so operational and information technologies can be seamless.