A vibrant market for M&A : Engineering and R&D Services

PARIS | LONDON | February 14th, 2023

Bryan, Garnier & Co technology equity research team is pleased to release A vibrant market for M&A: Engineering and R&D Services Update which takes a deep dive in market drivers, valuation issues and M&A in the Engineering and R&D Services industry.

Though the economic slowdown is here, the Engineering and R&D Services market has solid demand drivers in all industries thanks to structural changes pushing organisations to accelerate innovation: Industry 4.0, the will to reduce dependence on certain countries or certain suppliers, the implementation of sovereignty programmes, and the impact of environmental policies. Valuation multiples for listed Engineering and R&D Services firms look to have reached a trough, and players in this market have never been so cheap since 2019 and 2015-2016. In parallel, there is a vibrant market for M&A and private equity investment: the consolidation game is ongoing, and an increasing number of private and PE-backed Engineering and R&D Services firms are building up through acquisitions.

Bryan Garnier’s latest white paper reviews the business opportunities in the Engineering and R&D Services sector, as well as challenges for the industry. Read this report to learn about the key trends that will shape the Engineering and R&D services market, and understand why we consider the currently low valuation multiples in the Engineering and R&D Services industry provide further opportunities for M&A. Contact your Bryan Garnier representative if you would like to speak to the author, Gregory Ramirez.

Request the report

Please complete the form below to receive the report.

Bryan Garnier Announces Pierre-Georges Roy as a Partner in Its Investment Banking Team

NEW YORK, LONDON AND PARIS, 8 February 2023 –

Bryan, Garnier & Co, the leading investment bank for high growth Tech and Healthcare companies has announced that Pierre-Georges Roy has joined as a Partner in its US investment banking team.

Based out of New York since 1997, Pierre-Georges (“PG”) brings to the role more than two decades of experience advising on M&A and late-stage fundraising transactions for both US and European fast-growing Tech & Healthcare companies. He will contribute his extensive coverage of U.S. strategic and financial investors to the firm and will help enable a world-class, global investment banking team that has delivered over 300 transactions successfully for clients on both sides of the Atlantic since 2020.

Prior to Bryan Garnier, PG was a Partner for 17 years at M&A advisory firm Results International, sector specialist covering Tech & Healthcare companies. Prior to Results, PG led an investment team at New York hedge fund The Zanett Group, making buy-out investments in US tech firms. PG is a law graduate from McGill University in Canada.

Greg Revenu, co-founder and Managing Partner of Bryan Garnier, said: “With PG’s deal experience and extensive relationships with North American strategic buyers and Private Equity firms, we will add both to our U.S. execution capabilities and to our buyer and investor access for our clients both within the United States and in Europe, and will continue on our mission to offer first class credentials and capabilities on both sides of the Atlantic, enhancing our position as a premier, global full service investment banking firm”.

About Bryan, Garnier & Co

Partner-led and owned, Bryan Garnier is one of the world’s premier independent full-service investment banks for high growth healthcare and technology-led companies and their investors. Clients benefit from our relentless commitment to their long-term success, unparalleled insights into these strategically important sectors and strong relationships with investors – from private equity and venture capital to institutional and strategic investors across the US, Europe, and Asia.

As a sector driven investment bank, our advice is rooted in deep industry knowledge with a global perspective, and clients benefit from our full-service platform and product expertise that will accelerate their long-term success.

MEDIA CONTACTS

Desiree Maghoo, Questor Consulting

dmaghoo@questorconsulting.com

07772255740

Sophie Mills, Questor Consulting

smills@questorconsulting.com

07971406258

Bryan Garnier Expands Its Business and Tech-Enabled Services Investment Banking Team with the Addition of Eric Madar

LONDON AND PARIS, 31 January 2023 – Bryan Garnier & Co, the leading investment bank for European healthcare and technology-related companies has announced that Eric Madar has joined the firm as a Vice President. Eric joins the Business and Tech-Enabled Services investment banking team in Paris, where he will play a key role in deal origination with a particular focus on IT and engineering services, reinforcing the Bank’s leadership within this sector.

Eric’s previous roles include M&A Director at Segula Technologies, where he led the M&A Department and was very active on deal origination, and M&A analyst at Atos Worldline. Eric has over 10 years’ experience in corporate M&A within large companies, leading both domestic and cross-border M&A transactions from end-to-end. He has executed small to large cap deals across Europe, the US and Australia, involving companies that provide IT/Engineering services for a range of sectors including energy, healthcare and automotive sectors. Eric holds an MSc in Management with a major in M&A and strategic alliances from Audencia Business School in Nantes and studied Corporate Finance within University of Cincinnati in the US.

Guillaume Nathan, Partner and Head of Bryan Garnier’s Business and Tech-Enabled Services team said: “Having worked at a number of major corporates, Eric brings with him deep sector knowledge that will ensure our clients continue to benefit from expert sector-specific advice. His CEO relationships across the international IT/Engineering services ecosystem are unparalleled. Eric’s addition to the team supports our strategic ambitions, as we continue to lead in this important sector in Europe.”

Eric Madar, Vice President at Bryan Garnier said: “I am delighted to be joining Bryan Garnier to focus on deal origination and execution. I look forward to supporting clients across the European IT/Engineering services industry and leveraging Bryan Garnier’s full-service platform and access to US and European capital in order to deliver results for companies across this sector.”

In October 2022, Bryan Garnier’s Business and Tech-Enabled Services team advised full-service management consultancy Braincourt on its sale to Capgemini, global leader in consulting, technology services and digital transformation, demonstrating the Bank’s leadership in this space.

Alongside Business and Tech-Enabled Services, Bryan Garnier’s core sectors include Healthcare, Energy Transition and Sustainability, Software, Industrial Tech and NextGen Consumer. Bryan Garnier’s mission of investment banking for a better future continues to drive the firm as it backs disruptive companies and their investors that are providing solutions to some of the world’s most important challenges.

Bryan, Garnier& Co Sponsors Euronext’s TechShare Program 2023 To Support European Tech Companies To Go Public

PARIS, 26 January 2023 – Bryan, Garnier & Co, the leading investment bank for European healthcare and technology companies, today announced it is sponsoring the eighth edition of TechShare, as the Bank continues its partnership with Euronext. TechShare 2023, a 6- months one-of-a-kind educational pre-IPO program launched in Rotterdam today, led by the European leading market infrastructure Euronext, was created to provide customised and practical advice to technology growth companies in Europe they prepare to go public.

Bryan Garnier’s sponsorship of TechShare marks the second milestone in Bank’s long-term partnership with Euronext after the Euronext Tech Leaders’s sponsorhip. This initiative aligns with Bryan Garnier’s mission to provide outstanding advice and access to global capital for European disruptors in cutting-edge sectors including cleantech, hydrogen, e-mobility, cybersecurity, food and agri tech, healthcare, biotech and fintech.

Commenting on launch of TechShare, Euronext said:

“Euronext is happy to launch the 2023 edition of TechShare and IPO Ready, the pan-European pre-IPO educational programmes that supports European Tech companies aiming to go public in the next years. This year the programme will cover 9 European countries: Belgium, France, Germany and Central-Eastern Europe, Italy, the Netherlands, Portugal and Spain, plus Ireland and Norway. 140+ companies from 16 different Countries will be joining the 2023 cohort starting from the opening campus in Rotterdam.

During the six-month training programme structured around several main complementary modules, participants will discover the roadmap towards an IPO. In each country several workshop sessions will be held with expert partners covering the IPO process, the legal perspective, IPO valuation, equity story, financial communication, corporate governance and post-listing requirements. Companies will benefit from extensive individual coaching sessions with audit firms, lawyers, communication specialists and investor relations specialists providing customised advice.

Since the launch of Euronext’s TechShare and IPO ready pre-IPO educational programmes in 2015, more than 680 alumni have participated. With 700+ Tech companies listed on its markets, Euronext is the number one equity listing venue for Tech in Europe”

IT Services : The digital transformation steams ahead

PARIS | LONDON | January 25th, 2023

The Bryan, Garnier & Co software equity research team is pleased to release: IT Services Update: “The digital transformation steams ahead” which takes a deep dive into market drivers, valuation, and M&A in the IT services industry.

Though the economic slowdown is here, the digital transformation is still at the top of corporate agendas. Business model transformation, process automation, digital experience, supply chain resilience and, more recently, sustainable operations, require an increasing amount of IT work as these projects become mainstream. Valuation multiples for listed IT Services firms look to have reached a trough, and European players in this market have never been so cheap compared to their US and Indian peers since 2015. In parallel, there is a slowdown in M&A deals, but private equity funds remain very active in that domain, while some players refocus themselves on their most growing and profitable businesses through spinoffs.

Bryan Garnier’s latest White Paper reviews the business opportunities in the IT Services sector, as well as challenges for the industry. Read this report to learn about the key trends that will shape the IT services market, and why we consider the current low valuation multiples in the IT Services industry to provide further opportunities for M&A. Contact your Bryan Garnier representative if you would like to speak to the author, Gregory Ramirez.

Request the report

Please complete the form below to receive the report.

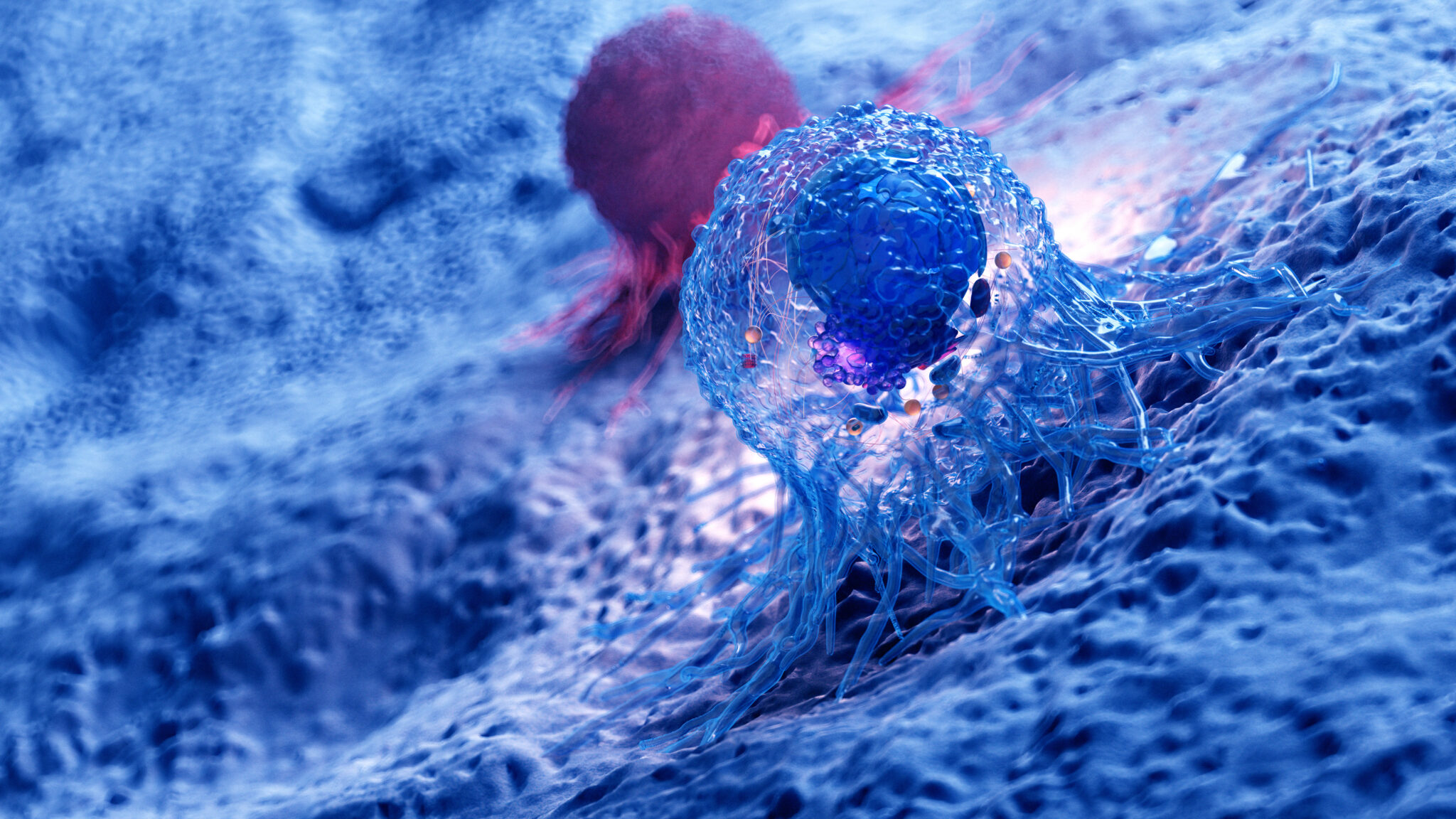

Bryan Garnier Innovation Series: TCR therapeutics

bethsabee gresse

HOSTED BY : BRYAN GARNIER HEALTHCARE RESEARCH TEAMMONDAY 6 FEBRUARY | 2pm - 4pm CET

Join our analyst Olga Smolentseva and our guests in roundtable discussions about the present and future of TCR-guided therapies in oncology. These conversations are a unique opportunity to get a comprehensive update and learn more from the European companies leading innovation in the field.

The Carbon Economy

Bryan Garnier’s Energy Transition & Sustainability Research team today published a White Paper on “The Carbon Economy: How to address the greatest challenge humans have ever faced?”, where we present an in-depth assessment of the road ahead towards zero emissions. Recently, at COP27, governments debated how restoring trust and dialogue between the two hemispheres could accelerate progress on climate finance. In 2022, with around 1.15°C global average increase in temperature and extreme heat events occurring 3.1x more often per decade than in pre-industrial times, we might already be late for the 1.5°C target. Backed by regulation, a flourishing ecosystem of the carbon economy is emerging, with companies progressively understanding they have no choice but to adapt to this new environment.

We explore the technologies that have the potential to reduce GHG emissions, improve their measurement, accounting, monitoring and certification. We also look at future developments and discuss which specific needs are addressed in the context of mounting pressure from consumers, investors, and policymakers to fight climate change.

Emissions reduction can only work with functioning and trusted carbon markets in place, for regulatory compliance or voluntary. Such markets are increasingly supported by industries looking for ways to mitigate unavoidable emissions. They allow new business models to emerge for the creation and trading of credits.

Contact your Bryan Garnier representative for more information.

Request the report

Please complete the form below to receive the report.

European cannabis

While the Americas have taken the lead in legalising cannabis for both medicinal and adult-use, the point of no return for global legalisation has passed and it is only a matter of time before other regions follow with progressive regulations. This is the case of Europe, where over the last two years, several initiatives have been taken to gradually legalise medical cannabis.

Specifically, these initiatives concern Germany, Switzerland, Spain, and France, while Israel is already on the forefront of medical cannabis research and access. Simultaneously, discussions concerning legalisation of adult-use cannabis seem to remove some of the stigma among physicians and patients. Indeed, several countries (the Netherlands, Switzerland, Malta, Luxembourg) are going a step further and are trialing adult-use regulations. However, Germany’s intent to deliver an adult-use cannabis market could be the trigger for legalisation in other European countries and deliver significant growth in the legal European cannabis industry. The way the German government has approached the international legality question is with an “interpretation declaration” to the other contracting parties. If the European Commission follows this German pathway, it would establish a blueprint for legalisation of cannabis in other European countries. Today, there is barely a legal European cannabis market to speak of, but the total market (99% illegal), is already EUR 65bn. As legalisation is spreading across Europe, we expect the size of the legal European cannabis market to grow to EUR 16.8bn by 2027 from EUR 0.8bn in 2022.

Request the report

Please complete the form below to receive the report.

Bryan, Garnier & Co becomes a partner in the Euronext Tech Leaders initiative

Paris, 23 November 2022 - Bryan, Garnier & Co, the leading European investment bank specialised in the financing of innovative, disprutive and growth companies, commits to the Euronext Tech Leaders initiative. This new segment, led by stock-market operator Euronext and launched last June, was created to strengthen the offer focused on tech companies in Europe.

The key European initiative

for European tech companies

Tech Leaders is a new initiative dedicated to highlighting the visibility and attractiveness of high-growth and leading Tech companies towards international investors, together with a suite of services to support them along their listing journey. The initiative involves the creation of a specific market segment housing more than 100 European listed, high-growth tech companies, including 41 listed in Paris.

Bryan, Garnier & Co,

partner to Euronext Tech Leaders

Bryan, Garnier & Co is making a long-term commitment to this project to support European tech companies active in cutting-edge sectors: cleantech (hydrogen, circular economy, e-mobility), cybersecurity, foodtech, biotech and fintech.

The agreement is a means of participating in the momentum generated by the tech ecosystem in a changing backdrop. As a first milestone, Bryan, Garnier & Co took part in the inaugural edition of the Euronext Tech Leaders Campus held yesterday (Wednesday 23rd November). The event is the new benchmark forum for the Euronext Tech Leaders community and high-potential private European tech companies, providing a place for Tech players sharing a common vision focused on innovation and growth to exchange and meet.

“Bryan, Garnier & Co is strengthening its position a pioneer in the financing of tech companies by supporting the Euronext Tech Leaders initiative. Many of the companies picked by Euronext Tech Leaders are clients that we have assisted in the various stages of their financing including Abivax, Carbios, HDF, Inventiva, Lhyfe, Mcphy Energy, Valneva, Voltalia and Waga Energy, and with whom we have built long-term relations. It is therefore logical for Bryan, Garnier & Co to invest in a project that aims to maximise their visibility and their success”, stated Greg Revenu, Managing Partner of Bryan, Garnier & Co.

The future of cybersecurity: TempoCap and Bryan Garnier lead the discussion on market trends and business concerns in 2023

By Sanjin Goglia, Managing Director, Bryan, Garnier & Co

and Damien Henault, Partner, TempoCap

Cybersecurity

is a constantly evolving sector

Ongoing digital transformation and the ever-changing threat landscape mean that recent years have seen the potential for threats proliferate and the need for robust solutions become more pressing. As a result, while the markets may be volatile, cybersecurity investment continues to weather the storm and retain strong demand and growth.

The global cybersecurity market, based on Gartner research, was valued at $140B in 2021 and is forecast to grow from $156B in 2022 to $376B by 2029 (a 13.4% CAGR). The increasing professionalisation of cybercriminals, aggressive ransomware attacks, and nation-state threat actors will all continue to compound cyber threats in 2022 and beyond.

As the leading cybersecurity investor in Europe, TempoCap has been at the forefront of investigating the market trends and concerns that corporates and institutions face. In 2022, a detailed research report we conducted in conjunction with prominent technology investment Bank Bryan, Garnier &Co exposed several pressing issues for businesses.

We are faced with a challenging macro environment and see many potential recession indicators, but the cybersecurity market outlook shows no sign of slowdown. The drivers for growth remain intact, including the continued digitalization of businesses, which creates pressure to invest in security technology, and increased regulatory pressure for corporates and public sector entities to put in place adequate cybersecurity strategies.

Our research has shown that CIOs are driving cybersecurity spend in 2022 and 2023 by making their top priority areas responding to an evolving and heightened threat environment, refreshing and upgrading existing technology and responding to the rapid attack surface expansion.

The latest Alphawise 2Q22 VAR (Value Added Reseller) and CIO surveys highlight this appetite for increased and continued cybersecurity spending:

VAR survey shows that 2022 Security Software growth expectations has sustained at 13% YoY for the past two Quarters

CIO survey shows Overall Security software spend growth expectations sustained at 9.4% in 2Q22 vs 4Q21, and remains well ahead of broader Software spend growth at 4.1%

Security software subsequently remains the most defensive area of IT spend, with Q1 and Q2 22 reports maintaining that these projects are least likely to see spending cuts

Our research has additionally uncovered how ransomware was a notable and continuing concern, with 27 percent of respondents mentioning it as the most significant cyberthreat currently impacting their industries and customers, followed by 18 percent of respondents identifying digital supply chain risk and attack surface expansion as the most pressing issues respectively. Geopolitical events, such as the Russian invasion of Ukraine, were also identified as a potential signifier of future cyber threats, while third party risks such as software chain supply were considered the most underestimated and overlooked security threat to businesses in 2022.

On the whole, businesses reported increasing cybersecurity budgets in response to possible vulnerabilities, but they also expressed concern in attracting and retaining talent, reflecting the post-pandemic “talent drain” many have been reporting in early 2022. In order to allow this hard-won talent to work effectively, those surveyed also expressed new desires for the efficiency of cybersecurity software, including measuring the accuracy of threat detection, the ability to seamlessly integrate with other solutions, and the reduction of false positives, rather than just the number of threats detected.

The respondents are right to be concerned about the efficacy of cyber security solutions, as the consequences of a breach are costly. IBM’s 2021 Data Breach Report found that 2021 had the highest average cost of a cyber-attack in 17 years – rising from $3.86 million in 2020 to $4.24 million. Average costs were also $1.07 million higher owing partly to the risks introduced by increase in remote working.

The appetite for robust solutions is clearly consistent and was a sentiment that was also reflected during TempoCap and Bryan, Garnier & Co’s inaugural Cyber Security Conference 2022. From global leaders to pioneering early-stage companies, this event highlighted the intricacies of the cybersecurity ecosystem and the crucial role these innovative companies play in protecting businesses in this age of insecurity. In addition to hiring talent and integrating effective software, speakers discussed how incorporating cybersecurity into employee training could enable businesses to keep digital best practices and monitoring at the top of the agenda. These new approaches to security awareness and training for broad employees population within companies could help to integrate security into the business culture, and ultimately cyber tech companies could help to facilitate this shift in mindset.

Maintaining agility emerged as an important theme and panellists discussed how best to enhance security whilst keeping your business running. A number of Chief Information Security Officers (CISOs) from large companies participated in the conference, sharing helpful advice with smaller companies, such as ensuring that their innovations can be integrated into wider platforms with minimal risk. Cybersecurity pioneers need to ensure that their solutions can be seamlessly adopted if they want exposure to big companies.

Equally, the Conference and the profitable legacy of TempoCap’s investments have shown that while the increased threat landscape continues to present challenges, it is also fuelling investment interest and creating a unique opportunity for deal making.

In 2021, the cybersecurity transactions market built on a strong performance as the total transaction value for M&A reached $78bn, while financing deals reached $29bn, with particular investment interest in endpoint safety, cloud technologies, identity and access management, messaging and network security and infrastructure security.

At the end of September 2022, the NASADAQ Cybersecurity CTA Index was down 26% from the beginning of the year but cybersecurity strategic activity demonstrated sustained volume, notably in M&A. $YTD Q3-2022, $16.5 bn has been invested across 799 cybersecuriyty financing transactions. M&A activity continues to be very significant from both strategic buyers and financial sponsors. During the first nine months of 2022, the total cybersecurity M&A volume was $111.5 bn across 206 transactions, a 138% year-on-year growth with 8x landmark $1bn+ M&A deals including Google’s $5.3B acquisition of Mandiant, Broadcom’s $69.2B acquisition of Vmware, and what appears to be a major roll-up in IAM space by Thoma Bravo with their $6.9B acquisition of SailPoint (at 31.6% trading price premium), $2.8B acquisition of Ping Identity (at 62% trading price premium) and most recent $2.3B acquisition of ForgeRock (at 53% trading price premium) . Further announced in October was the $4.6B acquisition of KnowBe4 by Vista Equity (less than two years after its IPO) – that illustrates the continued strength of Cybersecurity M&A.

Bryan, Garnier & co, as one the most active European investment banks in PE and growth tech/software deals with dedicated cybersecurity practice, has completed several high-visibility transactions in the space during 2022: MailInBlack acquisition by Apax Partners, EUR 28m investment round in Vade Secure, EUR 139m investment by Bridgepoint in CAST and acquisition of Sword GRC by Riskonnect (TA Associated backed company).

And among the TempoCap portfolio, companies such as Onfido, CybelAngel, EfficientIP and Systancia are going from strength to strength in designing secure solutions for developing cybersecurity issues.

As we ultimately continue to adapt to changing working methods and an increased reliance on technology to foster connectivity and to retain crucial data, the cybersecurity sector will face unique challenges.

Ahead of the forthcoming TempoCap and Bryan, Garnier & co 2023 Cyber Security Conference, our role in bringing key players together to discuss ideas and share advice has shown that organisations will keep searching for innovative solutions to meet these concerning obstacles, while targeted investment will ultimately push the needle forwards on change that is lasting and effective. The current environment represents a huge opportunity for cybersecurity companies and their investors to grow, develop and become global champions. Watch this space.